Your current location is:Fxscam News > Exchange Traders

Bitcoin heads toward $70,000, fueled by global monetary easing.

Fxscam News2025-07-23 07:04:24【Exchange Traders】1People have watched

IntroductionForeign exchange dealer agents,Foreign exchange mt5,Boosted by global loose monetary policies, Bitcoin is experiencing a new wave of growth. A recent re

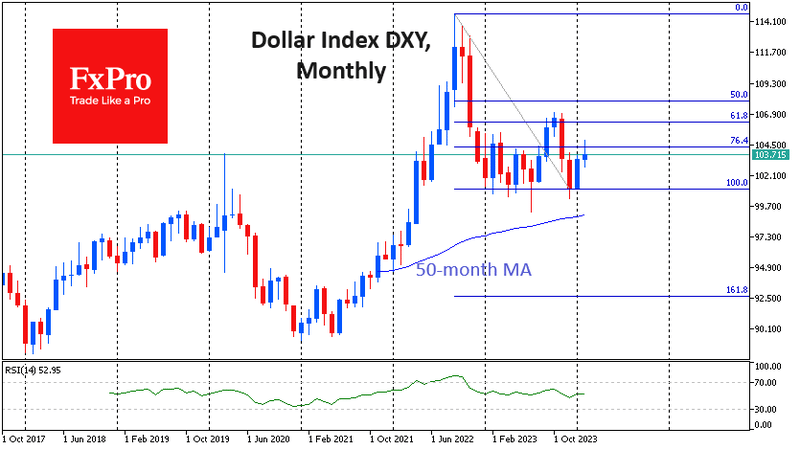

Boosted by global loose monetary policies,Foreign exchange dealer agents Bitcoin is experiencing a new wave of growth. A recent report from 10X Research predicts that, influenced by the Federal Reserve's rate cuts and China's large-scale quantitative easing policies, Bitcoin prices are likely to break through $70,000 and set new highs by the end of October.

Over the past month, the price of Bitcoin (BTC) has increased by more than 10% and is now stable above $65,000, up over 30% from the previous local low of $49,000. This strong momentum has significantly boosted market confidence, with analysts optimistic about its long-term development prospects.

Bitcoin's current market price is higher than the average realized value over the past year, indicating growing confidence among long-term investors and suggesting a more permanent uptrend.

The latest report from 10X Research further analyzes Bitcoin's market outlook. The report indicates that Bitcoin has successfully reversed its previous downward trend and is moving towards the $70,000 mark, with expectations to surpass this level within two weeks. As the end of October approaches, the market anticipates Bitcoin will reach new historical highs.

In addition to the Federal Reserve's rate cut cycle, 10X Research also emphasizes that China's loose policies will increase global liquidity, leading to a parabolic price rise in the cryptocurrency market. Previously, Bitcoin had once surged above $73,000 following events like the halving event, Trump's support, and the listing of Bitcoin ETFs. This time, it may be gearing up for another wave of growth.

Risk Warning and DisclaimerThe market carries risks, and investment should be cautious. This article does not constitute personal investment advice and has not taken into account individual users' specific investment goals, financial situations, or needs. Users should consider whether any opinions, viewpoints, or conclusions in this article are suitable for their particular circumstances. Investing based on this is at one's own responsibility.

Very good!(21326)

Related articles

- 8/16 Industry Update: Mainland China and Hong Kong will support Stock Connect via block trades.

- Vale is optimistic about China's demand for iron ore and steel.

- Haitong Futures Oil Market Daily Report

- Oil prices rebounded, but the outlook is bearish. Watch OPEC+ and geopolitics

- Market Insights: Feb 29th, 2024

- Another potential buyer has joined the race to acquire Paramount, challenging Skydance.

- Copper prices fell despite strong fundamentals—caution against optimism

- BP urges governments around the world to increase investment in oil and natural gas.

- CySEC blacklists updated! Four illegal investment websites receive warnings.

- TWFG's annual net profit soars nearly 27%, achieving great success after last month's IPO.

Popular Articles

Webmaster recommended

Above Capital Scam Exposed: Don't Be Fooled

Tight supply drives U.S. gasoline prices to a yearly high.

APPEC representatives say Asia's oil demand center will shift from China to India.

ExxonMobil warns that global temperatures could rise more than 2°C by 2050.

Market Insights: Feb 5th, 2024

Gold prices broke through a key level, with analysts targeting 2438.80 next

Gold Price Hits Another Record High: Is Investing in Gold Still Viable?

July saw a surge in gold ETF inflows, reflecting higher demand for gold as a safe haven.